Pillars of Entrepreneurship

Being an entrepreneur has never been sexier and easier than it is today. But what does the 12-letter word (that is hard enough to say let alone spell) even mean? The 19th century origin of the word comes from the French “entreprendre” meaning “to undertake” combined with the English “enterprise”. A quick Google search will tell you something along the lines of “one who organizes, manages, and assumes the risks of a business or enterprise.” However, with more paths towards “being your own boss” than ever before, I’ll break down the buzzword into four distinct categories or “Pillars” so that you (future entrepreneur) can better understand what might be the best path given your goals, skills, and risk tolerance.

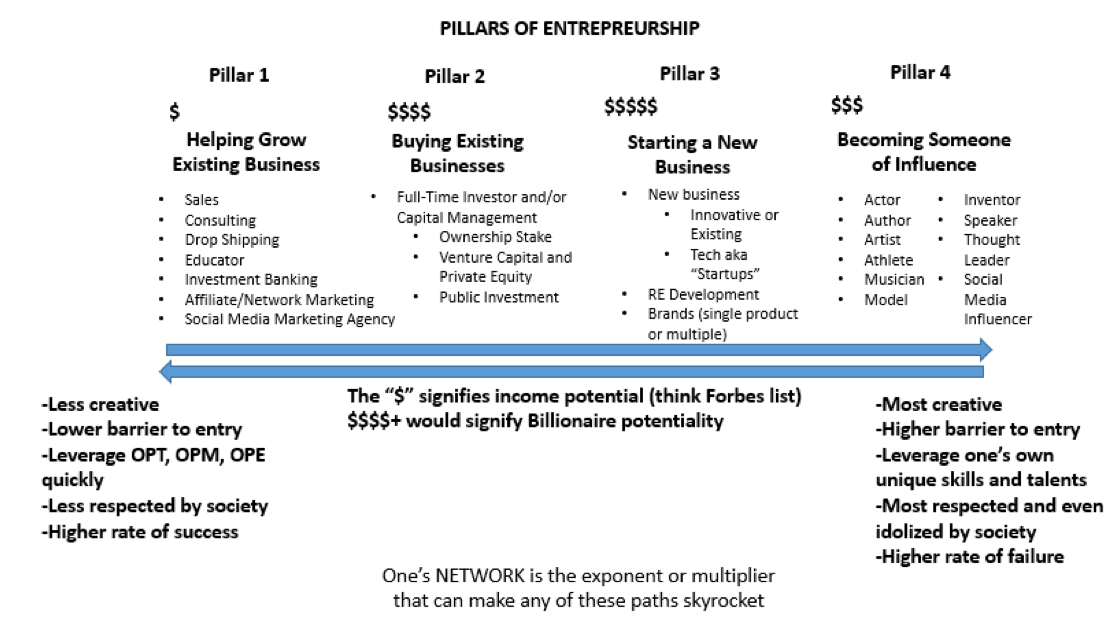

The four “Pillars of Entrepreneurship” are: 1. Helping to grow existing businesses, 2. Buying (whole or parts of) existing business 3. Starting a new business and 4. Becoming someone of influence. In general, as one moves up each pillar, there is typically a higher rate of failure as the level of ambiguity and creativity demanded to succeed increases exponentially. Accordingly, society most respects and even idolizes those willing to play (and succeed) at the higher pillars of the chart shown below.

Pillar 1 – Helping Grow Existing Businesses:

-This is first step towards entrepreneurship and where most people will spend their entrepreneurial careers.

-Leave the world of corporate American, forgo a set salary of any kind, and are compensated solely based on results.

-I’d agree with Gary Vaynerchuk in that, unless one is full time pursuing any of these starting points, they’re not really in the game and would instead simply have “entrepreneurial tendencies”.

-Don’t own any significant equity in the business or related assets in general.

-Least creative as the product, service, or asset has already been created.

-Lowest barrier to entry in terms of skills required, education, or talent needed.

Examples:

Both network and affiliate marketers get paid a commission to market and sell a company’s product while leveraging a greater corporate brand, business plan, manage employees, etc. Virtually anyone who so desires can join a network marketing company with a relatively small investment anywhere from $100 to a few thousand dollars.

Most commission-only salespeople like real estate agents and car salesman are paid a commission only if a deal gets done. These roles typically aren’t in short supply as the market will always demand good salespeople. For less than $500 hundred dollars one can get their real estate license in a few months. “Garage sale arbitrage” and other forms of traditional buying and selling of goods would fall under this sub category.

Consultants are typically hired by a client to help fix problems that ultimately aid in increasing revenue or decreases expenses. Popular consulting entrepreneur and educator, Sam Ovens, who launched Consulting.com is only one example of how you don’t need to be partner at a “Big Four” Consulting firms to become a millionaire in this path. In fact, unless you’re shooting to work at Bain, McKinsey or the “Big Four” consulting firms, there’s virtually no barrier to entry to help other businesses succeed.

Drop shipping is one of the hottest online businesses to start in 2020. A subsect within E-Commerce (selling things online), drop shipping typically involves importing products from a cheap ecommerce store to one’s website and promoting them on social media and search engines. In this way, one can sell popular generic or non-unique products such as slime, magnetic charging cables, and moon lamps direct to consumer for a very small startup investment built on platforms like Shopify and Amazon FBA. The vast majority of entrepreneurs who’re capitalizing on the opportunity in this space are aren’t creating their own unique brands or products, which would otherwise be classified under Pillar 3. It seems like every other YouTube ad these days is marketing a < $100 course on how you too can become the next drop shipping millionaire.

“Educators” are individuals that sell their (or someone else’s) knowledge to the public for a fee. To cater to the masses of people looking to work for themselves, the hottest informational courses to sell typically relate to success in the various paths under Pillar 1. Very few Educators attempt to teach those how to enter and succeed at higher pillars due to the complexity, risk, and lack of repeatable formula associated with success. Not surprisingly, even personal development legends like Tony Robbins and Dean Graziosi have recognized this massive trend in consumer spending on self-education as even they’ve become Educators, teaching how you too can become (what they call) a “Knowledge Broker” for only $1,997! Few Unfortunately, the internet is full of new Educators who’re making millions off of “teaching” how to become a millionaire online…ironic right? That all being said, grow big enough as an Educator, and one may have the possibility to jump to Pillar 4: Becoming someone of significant influence.

Starting one’s own Social Media Marketing Agency (SMMA) has also skyrocketed in popularity driven by the gap in knowledge between baby boomer business owners and millennial/Gen Z familiarity with technology and social media. The former knows that they need to adapt to the ever-evolving channels by which their customers are consuming media and the latter are uniquely positioned to offer them these marketing services. At the highest level of this path, the media mogul himself, Gary Vaynerchuk, has built a marketing behemoth that is Vayner Media. However, because he has built a brand that services primarily Fortune 500 businesses, I’d consider his enterprise to be more so that of a Pillar 3 business.

-It’s not that these paths aren’t necessarily respected by society, they’re just the least respected of the four Pillars. For example, even mention the word network marketing to most people and you’ll get a skeptical reaction to say the least. And being compared to a “used car salesman” doesn’t get the best rap either. That being said, I wouldn’t discount the importance of this pillar or the sales skills that are required and honed. You may find that at the top of most industry, the highest functioning positions (even C-Suite execs) are typically over glorified sales roles. While perhaps overly simple, I’d largely agree with the adage, “sales cures all.”

-Lowest income potential of the four pillars. The top earners in this pillar may make several million per year but it’s very difficult to amass significant sums of wealth (> $10-20 million) in this category alone because of the lack of equity ownership in a business that can grow exponentially. Also, because the barrier to entry is relatively low, the increased competition typically fragments the market which divides total earnings whereas fewer individuals or businesses can dominate the market, earning outsized incomes in the other pillars. For example, the top 10 individual car salesmen can’t dominate their market like Leonardo Dicaprio can dominate the male acting roles in the film industry, Apple can dominate big tech, or Blackstone can dominate the investment management business.

-That being said, this is quite often the best place to start as someone interested in entrepreneurship but with little time, money, skills, or unique talent to begin with. The path to success in this pillar is relatively clear as one can most easily learn from and repeat the effective actions of others.

Primary Skills Required: Sales, Marketing, Networking, Communication, People Skills, Soft Skills

Education Required: Formal education (e.g. college degree) not required and often irrelevant

Pillar 2 – Buying Existing Businesses:

-Commonly known as a full-time investor. Does not include the masses who simply invest their earned income (from a job) into assets. The vast majority of their earnings come from the cashflow and/or increased value to their investment (added by them or others), along with perhaps a small portion from earned management fees of the capital they manage (if not solely their own).

-Identified sound business opportunities and risks their own capital and/or other people’s money (OPM) to take a controlling position in a business or asset.

-Less creative than a “true” entrepreneur having to come up with products/services from scratch but still someone who has to search the marketplace for value and make financial bets on products, services, and businesses in various stages of their life cycle. Great investors, like Pillar 3 entrepreneurs, are typically visionaries that understand markets and people very well while being able to accurately predict future demand for various products and services.

-Higher barrier to entry as even just breaking into the industry typically requires either an esteemed degree from a top school, a particular investment skillset, specialized industry knowledge and/or large sums of money to invest on behalf of yourself or others. It’s primarily in Pillars 2 and 4 that one’s collegiate and familial pedigree help one break in and rise to the top.

-Investment banking has traditionally been one of the best corporate jobs to break into Pillar 2 due to the extremely relevant analytical skillset and exposure to the investment industry one gains through 1-2+ years of 80-100 hour work weeks. However, even the most successful investment banking partners (not analysts/associates who’re employees of the firm) are considered to be Pillar 1 entrepreneurs as they’re payed a fee to help their clients raise capital in order to finance various activities and grow their businesses.

3 Main Ways to Play:

Ownership Stake: Direct investment by an individual/owner into the business that he/she owns.

For example, Donald Bren (because the other Donald in real estate is a less popular example) is the sole chairman and owner of the Irvine Company – a Southern California based real estate investment firm. Bren, only investing his own money (~$17 billion net worth) owns roughly one-fifth of Orange County, an area five times the size of Manhattan.

Venture Capital/Private Equity: An investment by venture capital/private equity funds taking stakes in start-ups, mature companies, and other capital-intensive assets like real estate.

Don Valentine, commonly referred to as the "grandfather of Silicon Valley venture capital", was one of the original investors in Apple Computer and went on to found one of the most successful VS firms in to date: Sequoia Capital.

After a 15+ year investment banking career, Stephen Schwarzman founded the esteemed private equity firm Blackstone to invest in private companies on behalf of institutional clients.

Public Investment: Investment by the general public into the shares of publicly traded companies.

Warren Buffet has acted in all three of these strategies throughout his investment career but currently (as of 12/31/19) owns a significant portion of several public companies such as American Express (18.7%), Apple (5.7%), Bank of America (10.7%), and Coca-Cola (9.3%)

- These three main paths describe how, at a very high level, one can play the entrepreneurial investment game. But within any of these paths, an investor will then have to choose where to invest their money aka which asset classes: equities (stocks), fixed income (bonds), cash equivalents (treasury bills, bank CDs, etc.), or alternative investments (real estate, artwork, cryptocurrencies). While each have their own pros/cons and are often uncorrelated, many would agree that diversification can reduce a portfolio’s overall volatility.

-Pillar 2 is an enormous step up in respect by society as compared to Pillar 1 entrepreneurs but even the best investors aren’t quite idolized like successful Pillar 3 entrepreneurs and especially not Pillar 4 celebrities. Most people can probably name less than one or two super successful full-time investors, likely being the “Oracle of Omaha” Warren Buffet only because he has topped the Forbes list for over 30 years.

-While Pillar 2 is far from a “get rich quick” path like that more possible in the other pillars, the amount of wealth that can be built over a lifetime is truly staggering. There’s no surprise that Pillar 2 investors and Pillar 3 entrepreneurs line the Forbes list of wealthiest people on the planet. This is possible primarily due to the fact that assets can grow multiply over time, and with the proper use of financial leverage, these holdings can grow exponentially. Less than 50 years ago, the private equity business didn’t even exist as we know it today. However, the older word “Financier” was more commonly used to describe historically revered investors like JP Morgan (founder of JP Morgan) and Marcus Goldman (founder of Goldman Sachs).

-Not only is it much harder to break into than Pillar 1 but the rate of failure is much higher as well. They say that one in 10 businesses “fail”, meaning that one’s odds for picking good assets and businesses to invest in over time probably aren’t a whole lot higher. In fact, after 15 years, 92% of large cap funds underperformed the S&P 500. Back in the 1970s there was a group of stocks, called the “Nifty 50”, that investors believed were virtually indestructible and one’s to “buy once and never sell” (according to University of Pennsylvania professor Jeremy Siegel). Today less than half of them remain as independent companies. Remember, if investing was easy, everyone would be a millionaire.

-However - especially true in Pillar 2 - risk is often commensurate with reward. For example, venture capitalists betting on early stage startups are taking exponentially more risk than other styles of investing but are hoping to make 10x+ the returns. I may be biased but I would still argue that Pillar 2 offers the highest risk adjusted returns over any career path and that Real estate is still the best investment you can make today.

-We can all learn to better earn money, keep money, and grow money. At best, a small proportion of the population excels at earning money (average income in the US is roughly $62k per year in 2018). In addition, most people are likely to believe that they pay too high of taxes as a result of not knowing how best to “keep” their money (legally) from the IRS. Even fewer who know how to keep money know how to grow their money via investing. Pillar’s 1, 3, and 4 can be phenomenal earners, but without knowing how to keep or grow one’s money (largely skills of Pillar 2), one can easily end up like Mike Tyson – the infamous American boxer with over $300 million career earnings who has little to nothing to show for it today.

Primary Skills Required: Financial literacy (general finance and accounting), Hard skills, general business and economics, delayed gratification, risk management, mastering one’s emotions.

Education Required: Formal education still highly valued and often required as an entry point

Pillar 3 – Starting a Business:

-Entails starting a new business from scratch and what I would call the truest form of entrepreneurship. However, there’s a considerable distinction between whether the business is either non-innovative aka previously existing/non-unique or “innovative” meaning a product, service, or business model that the world has never quite seen before. The latter having exponentially higher income potential for the outsized value added to the world.

-What really defines the success of all pillars, but especially Pillar 3 opportunities, is their ability to scale. Whether a business is innovative or not and the scale to which that business can grow dictate how much value and thus income it can generate represented by the following equation:

How innovative Is the product, service, or business model? (1-10) x

How easily scalable is it to the masses? (1-10) = Impact Score

-Especially for businesses that seek to innovate, there is an extremely high level of creativity required to succeed and to continue to succeed. For example, from 2005 to 2008, Myspace was the most popular social media site but but because they failed to continue to innovate, Facebook gained traction and ultimately dominated the market. Do most kids today remember Blockbuster? Neither does Reed Hastings.

-While Pillar 3 entrepreneurs certainly don’t need an esteemed college degree or special talent in particular, there remains a very high barrier to entry in terms of both soft and hard skills required, market knowledge, and a competitive edge to ultimately succeed (which shouldn’t be understated). The marketplace is extremely efficient and the bigger one’s vision for a new product, service, or business model, typically the harder it will be to bring it to life. Lastly, one must possess a very high tolerance to ambiguity as the roadmap to building a successful new business doesn’t quite exist like that of Pillars 1 and 2 where one can more easily learn from strategies of those who precede them.

Examples:

Innovative businesses

Amazon – the world’s largest retailer and e-commerce store created and scaled an entirely new way for consumers to buy nearly anything online.

Netflix – the world’s largest subscription streaming service revolutionized how the world is entertained and changed the way content is distributed and consumed.

Facebook – the largest social media platform changed the way people connect online. If CEO, Mark Zuckerberg, can’t create the next big social media platform, he’ll buy it. Acquired Instagram for $1 billion in 2012, now estimated to be worth nearly $100 billion only 6 years later.

Airbnb and Uber created brand-new business models in which neither own the homes or cars their customers use yet are the largest accommodation provider and taxi company, respectively.

Non-innovative “Existing” businesses

Natural Resources – Mukesh Ambani chairs and runs $88 billion (revenue) oil and gas giant Reliance Industries, among India's most valuable companies. In China, Qin Yinglin is worth nearly $18.5B from pig breeding…

Public and Private Services – Mexico's richest man, Carlos Slim Helu and his family control America Movil, Latin America's biggest mobile telecom firm.

Real Estate Development. While real estate is considered an asset class in and of itself, income producing real estate also resembles a traditional businesses: a physical structure aka “the product” that generates income and has expenses. Buying existing real estate, that which has already been built, would be considered under Pillar 2 while real estate development requires an added layer of creativity and risk associated with building from the ground up. Some of the most iconic real estate billionaires in America have built their wealth as Pillar 3 developers: Donald Trump, Stephen Ross - owner of Related Companies, Rick Caruso – built the famous “Grove” shopping center in LA.

Brands – refer to a name, term, design, symbol or any other feature that identifies one seller's good or service as distinct from those of other sellers. Examples include:

Nike – formerly known as Blue Ribbon Sports was founded by Phil Knight and has been an enormous innovator in shoe and sportswear technology.

LVMH – is a French multinational corporation specializing in luxury goods. Owner and 3rd richest man in the world (behind Jeff Bezos and Bill Gates), Bernard Arnault & Family oversees an empire of 70 brands including Louis Vuitton and Sephora.

Other conglomerates like Procter and Gamble, General Foods, and Unilever

Private Labeling such as Costco’s “Kirkland” brand or Whole Foods “365”

-Retailers are some of the richest people on the planet because they combine: Pillar 1 by helping grow hundreds if not thousands of other businesses existing brands they sell. Pillar 2 by investing in existing businesses by owning commercial (retail/industrial/office) real estate for their stores/distribution as well as potentially acquiring other brands. Pillar 3 by creating their own brand (ex. Amazon, Walmart) from scratch, while also creating and selling their own products under their private label (ex. Amazon Echo).

-Pillar 3 entrepreneurship has the highest income potential of all. The world is constantly evolving and continues to demand new products and services. For entrepreneurs that can creatively meet those needs, the sky (if not governmental regulation limiting monopolies) is truly the limit. Technology entrepreneurs have a particularly large presence on the Forbes list due to the nature of their businesses being highly innovative and (with very low to no variable costs depending on the business model e.g. SAAS) easily scalable for the entire world to adopt and benefit from. The term “startup” was first used by Forbes to describe new, high growth technology business back in the mid-1970s at the dawn of the internet.

-Very highly respected by society but not quite idolized like Pillar 4 celebrities probably because 1) society puts celebrities on a pedestal with various halo effects and 2) most business owners aren’t public faces of the companies they own and are not the “product” themselves like celebrities are.

-Very high rate of failure. Especially with innovative businesses, finding product/service market fit is more of an art than a science with no guarantees. Generally, risk and reward increase proportionally and entrepreneurs who’re solving the world’s biggest problems are compensated handsomely by society. If one doesn’t want nearly the risk (or reward) associated with being a true entrepreneur, they may consider starting as an Intrapreneur instead.

Primary Skills Required: Often both soft skills and hard skills related to starting/operating a business and managing people.

Education Required: Formal education can be very helpful, especially if one wants to launch an innovative business, but certainly not required – just ask high school dropout, Richard Branson. However, many of the world’s most prolific entrepreneurs have invested heavily in traditional educations at some of the most prestigious universities: Jeff Bezos (Amazon) studied computer science and electrical engineering at Princeton. Larry Page (Google) got a bachelors in CS from University of Michigan and a Masters from Stanford. Bill Gates (Microsoft) and Mark Zuckerberg (Facebook) both dropped out of Harvard. Both Snapchat and Instagram founders attended Stanford University. Elon Musk (Tesla, SpaceX) studied economics and physics at the University of Pennsylvania and dropped out of a physics PhD in at Stanford to start is first company Zip2.

Pillar 4 – Becoming Someone of Influence:

-Encompasses a wide variety of roles but all have in common the ability to garner the attention of and thereby influence the masses (millions of people) from their extraordinary talents, ideas and content.

-Common term for many of these sub paths is “celebrity”, which literally means “a famous person” or “a state of being well known”.

-Contrary to the other Pillars, most Pillar 4 celebrities are typically the “product” themselves. I believe part of the reason why we see so many incredibly successful yet utterly depressed celebrities is because as an entrepreneur, it’s quite impersonal if society doesn’t like your product or service as you can relatively easily pivot ideas whereas players in Pillar 4 face more personal criticism in this regard. If one’s entire income is based off people’s perception of YOU (not your product or service) then there’s a ton of pressure to never fail and live up to a level of perfection that’s simply impossible to maintain.

-Besides those that rely solely off their physical gifts and talents alone (Athletes and Models), success in this path demands the highest level of creativity. And while one can draw inspiration from other Pillar 4’s work, the greatest have a unique sound, style, or set of ideas that they have perfected better than all else.

-Highest barrier to entry not because one needs certain skills or education but instead talent to truly set oneself apart from the competition.

-Very high-income potential with the top earners pulling in hundreds of millions of dollars. However, not even the biggest actors, singers, athletes are able to hit billionaire status by their talents alone. Boxing legend, Floyd Mayweather is the highest paid athlete with career earnings of $915 million. Pillar 1 promotional sponsorships from large brands, Pillar 2 investments in synergistic businesses, and Pillar 3 new business launches typically related to their personal brand (ex. Post Malone’s recent rosé launch of “Maison No. 9”) are three strategies Pillar 4 celebrities typically use to multiply their outsized earned incomes. For example, Michael Jordan is widely considered to be the best basketball player of all time. Even with less than $100 million in career earnings, he reportedly became the world’s first billionaire athlete, earning an insane $100 million per year from Nike royalties alone.

-Access to enter Pillar 4 has increased the most largely due to the internet. Actors who used to only act on stages and in movies now have YouTube to showcase their talent and grow their brand. Authors who had to get their content published in a select group of print newspapers or magazines now have countless social media sites as well as free publishing sites like Medium. Artists can not only express themselves in more ways with technology, but they can display their work on channels that better cater to younger demographics.

-While the other pillars can leverage other people’s money, skills and experience to achieve success, Pillar 4 is unique in that all the success relies on you and your own abilities. Beyoncé can’t have someone else go up on stage to sing her songs. There is little to no roadmap to repeatable success.

Examples

Actor – traditional (outdated) definition is “a person whose profession is acting on the stage, in movies, or on television.”

Leonardo DiCaprio has starred in some of the most iconic biopics and period films, which have earned a total of $7.2 billion worldwide. He has placed eight times in annual rankings of the world's highest-paid actors.

Author – traditional (outdated) definition is “a writer of a book, article, or report.”

J.K Rowling, creator of the acclaimed Harry Potter series, became the world’s first billionaire author while poor and almost homeless.

Artist – one engaged in an activity related to creating art, practicing the arts, or demonstrating an art. The lines get blurred here as all musicians may be considered artists but not all artists are musicians.

Both Banksy and Alec Monopoly are good modern day examples of artists that have rose to fame through their street art broadcasted over social media.

Athlete – a person who is proficient in sports and other forms of physical exercise. Football, Basketball, and Baseball attracting the most attention in the US while Soccer is the premier sport throughout the world.

Pro basketball player, Stephen Curry of the Golden State Warriors, is widely considered the greatest shooter in NBA history and recently signed the richest contract in NBA history. Five years, $201,158,790 for an average of $40,231,758 annually.

Musician – encompassing primarily rappers, singers, songwriters, and record producers although classical musicians, while far less relevant, would certainly be included.

It wasn’t long ago that revered rapper Kanye West was $53 million in debt and asking Zuckerberg for money. Now, he’s a billionaire in large part due to his partnership with Adidas as his Yeezy sneaker empire paid him an estimated $140 million last year.

Model – Agencies like Wilhelmina Models are still relevant; however, Social media has changed the game for physically attractive men and women to grow their brand from the ground up.

Bella Hadid is one of the biggest models of today with a staggering 30.7m IG followers.

Inventor - create and materialize great products vs business owners who market and sell them. Often both but not always. The Entrepreneurs that can do both are more public figures like Steve Jobs and Elon Musk, even Benjamin Franklin.

Thought leader - one whose views on a subject are taken to be authoritative and influential. While anyone can have unique thoughts and ideas, a thought leader is different in that their innovative ideas influence the thinking of the masses.

Tony Robbins is an author, public speaker, and life and business strategist. While he has greatly diversified his business holdings of “more than 50 privately held businesses with combined sales exceeding $6 billion a year”, he’s first and foremost a thought leader around all thing’s personal achievement.

Social Media Influencer (personal brand) Today we’re seeing social media – particularly Instagram and YouTube – allow the everyday person to become a person of influence (4) whereas this path was typically reserved for the big movie starts etc. Through social media, virtually anyone can grow their following by posting content desired by the masses. Once these Instagram/YouTube influencers/models have influence and reach, they can monetize easily because they have a) have attention and b) seem more authentic and have the trust of their audience. Once you have a significant amount of attention aka “fame”, you can monetize in a variety of ways through self-promotion of you or your Pillar 3 brand (e.g. Maverick Clothing by Logan Paul), or through promoting other companies Pillar 3 products/brands (Pillar 1 affiliate marketing).

Logan Paul is an American YouTuber, internet personality, and actor with over 25 million combined subscribers and over 5 billion total views on his content (insane). He gained a following in 2013 by posting sketches on the video-sharing application Vine, before it was bought and ultimately shut down by Twitter.

-Highest rate of failure among the paths. Constant battle to stay relevant with rapidly evolving consumer preferences, however, the very best go down in history (artist Michael Jackson, thought leader Stephen Hawking).

-Most all super successful Pillar 4 entrepreneurs aka celebrities are idolized by society, especially actors and musicians. The whole world looks up to these people as the upper echelon of success and quite frankly rank highest on the social hierarchy of status. So…would you rather be rich or famous?

Primary Skills Required: Talent and or beauty often helps the most in addition to massive amounts of creativity and belief in oneself.

Education Required: Formal education is largely irrelevant, if not negatively correlated. Many of the world’s most talented didn’t focus on or even finish traditional schooling, instead being creatively focused on perfecting their own talents at a young age. I’ve noticed a general trend that Pillar 4 celebrities often either come from very poor families or ultra-rich families, otherwise few and far between. I believe this is because underprivileged kids typically can’t afford extracurriculars, let alone higher education, so they’re more likely to double down on their God given talents without a strong opportunity cost that most middle and upper middle class kids face, that is, getting into a good college and then a “good job”. Super rich kids on the other hand can literally and figuratively afford to follow their dreams with an enormous safety net to fall back on if they “fail”. For example, they can afford the best coaches and - if their parents aren’t already Pillar 4 celebrities themselves - more or less pay for access into the high barrier to entry entertainment industry. Don’t agree? Ask Jaden Smith.